Caribbean Real Estate Decisions Start With The Right Comparable Data

Why Accurate Property Comparisons Protect Buyers and Sellers In Caribbean Real Estate

Purchasing Caribbean real estate is one of the most significant financial decisions most individuals and investors will ever make. Whether the objective is to secure a primary residence, acquire a vacation home, or build a long-term investment portfolio, the quality of the data used to inform that decision is paramount. Among all forms of real estate analysis, comparable data—commonly referred to as “comps”—is one of the most critical tools available to buyers. Without accurate and relevant comparisons, buyers risk misjudging value, overpaying, or making investments that fail to perform as expected.

The majority of the Caribbean consists of regulated real estate markets along with fragmented oversight (a situation where the responsibility for regulation, data management, and operational processes is dispersed across multiple, poorly coordinated entities, leading to inefficiencies, increased risks, and a lack of transparency) markets which results in some cases of data not being collected. Using third-party data analytics companies, like AirDNA, can help guide a potential investor down the road of decision concerning purchasing property.

Comparable data in Caribbean real estate allows buyers to evaluate a property not in isolation, but within the context of the broader market. It provides a reality check against asking prices, marketing claims, and emotional impulses. When used correctly, it promotes informed decision-making and financial discipline. When used incorrectly—or worse, when inaccurate or misleading data is presented—it can lead buyers astray and result in costly mistakes.

What Comparable Data Really Means In Caribbean Real Estate

In Caribbean real estate, comparable data refers to recently sold or currently listed properties that share similar characteristics with the property under consideration. These characteristics typically include location, size, number of bedrooms and bathrooms, lot size, building age, condition, and amenities. The purpose of comps is to establish a reasonable market value by observing what buyers are actually willing to pay for similar properties under similar conditions.

However, not all comparisons are created equal. Superficial similarities can be misleading if deeper variables are ignored. True comparability requires precision and discipline. This is especially important in markets where pricing can vary significantly within short distances or between seemingly similar properties.

Why Bedroom Count Matters

One of the most common and critical comparison points is the number of bedrooms. Properties with different bedroom counts often appeal to entirely different buyer segments. A two-bedroom condominium, for example, may attract young professionals, retirees, or short-term rental investors. A four-bedroom single-family home is more likely to appeal to families or long-term residents. These buyer profiles come with different budgets, priorities, and willingness to pay.

Comparing a two-bedroom property to a three- or four-bedroom property can artificially inflate or deflate perceived value. Larger homes generally command higher prices not only due to increased square footage, but also because of their broader usability and resale potential. Using mismatched bedroom counts in comparisons can distort pricing expectations and create false benchmarks that do not reflect true market behavior.

For buyers, this can result in overpaying for a smaller property under the assumption that it aligns with higher-priced listings that are not genuinely comparable. For investors, it can lead to flawed yield projections and unrealistic exit strategies.

The Importance of Location Consistency in Caribbean Real Estate

Location is another non-negotiable element of accurate comparison. Real estate values are highly sensitive to micro-markets. Two properties that are only a few miles apart can have drastically different values due to differences in neighborhood quality, infrastructure, access to amenities, school districts, safety, and future development plans.

Comparing properties across dissimilar locations—such as a beachfront area versus an inland neighborhood, or a tourist-heavy zone versus a residential district—undermines the validity of the analysis. Even within the same city, price per square foot can vary widely between neighborhoods. Buyers who rely on location-inconsistent data may believe they are getting a “deal,” when in reality they are misunderstanding the market dynamics of the specific area.

For international or out-of-market buyers, who may already face information asymmetry (a situation where one party has more or better information than the other), accurate location-based comparisons are even more critical. Poor data in these cases can magnify risk and lead to decisions based on assumptions rather than facts.

The Risks of Displaying Incorrect or Misleading Data

Displaying incorrect, outdated, or poorly selected data is not merely an inconvenience—it can be actively harmful. When buyers are presented with misleading comparisons, they may develop unrealistic expectations about appreciation, rental income, or resale potential. This can result in harmful investments that underperform or, in worst cases, generate losses that could have been avoided with proper analysis.

For example, showcasing a low-priced property alongside higher-priced listings with more bedrooms or superior locations can create a false sense of value. Buyers may believe they are purchasing below market, only to discover later that the property’s true comparables support a much lower valuation. Similarly, using data from peak market conditions to justify pricing in a cooling market can misrepresent current realities and encourage overpayment.

From an industry perspective, poor data practices also erode trust. Buyers who feel misled are less likely to engage confidently with agents, platforms, or developers in the future. Transparency and accuracy are not just best practices; they are foundational to sustainable market participation.

Accurate Comparisons Insight

Comparing beachfront or near-beach properties to properties that are not near the beach is fundamentally flawed because proximity to the ocean introduces a distinct set of economic, behavioral, and risk factors that materially affect value. These factors create two different markets, even when the properties may appear similar on the surface.

1. Beach Proximity Creates a Separate Demand Curve

Properties near the beach benefit from a premium driven by lifestyle appeal, scarcity, and emotional purchasing behavior. Buyers are not simply purchasing square footage or bedroom count; they are purchasing access to ocean views, walkability to the shoreline, and a coastal lifestyle. This creates demand that is less price-sensitive than demand for inland properties.

In contrast, non-beach properties are typically valued based on more utilitarian factors such as commuting convenience, neighborhood infrastructure, or long-term residential use. When you compare the two, you are mixing fundamentally different buyer motivations, which invalidates any pricing conclusions.

2. Scarcity Dramatically Impacts Value

Beachfront and near-beach land is inherently limited. Coastlines cannot be expanded, and zoning restrictions often further constrain new development. This scarcity supports higher pricing and long-term value retention.

Inland properties do not share this constraint. Additional housing supply can often be developed nearby, which places natural limits on price appreciation. Comparing these two asset types ignores the scarcity premium that coastal properties command and leads to distorted valuations.

3. Rental Income and Use Cases Are Not Comparable

Near-beach properties frequently generate higher short-term rental income due to tourism demand, seasonal pricing spikes, and high occupancy during peak travel periods. Many are optimized for vacation rentals rather than long-term tenants.

Non-beach properties are more commonly positioned for long-term residential rentals with steadier but lower yields. Comparing these properties without accounting for different rental strategies can lead to inaccurate income projections and flawed return-on-investment assumptions.

4. Risk Profiles Are Fundamentally Different

Coastal properties carry unique risks, including exposure to salt air corrosion, higher maintenance costs, hurricane or storm exposure, flood risk, and elevated insurance premiums. These factors materially affect ownership costs and net returns.

Non-beach properties typically have lower environmental risk and maintenance expenses. Comparing prices without adjusting for these cost differentials misrepresents the true cost of ownership and can mislead buyers into underestimating long-term expenses.

5. Appreciation Patterns Behave Differently

Beach properties often appreciate based on lifestyle demand and global buyer interest rather than purely local economic conditions. They may hold value better during downturns or rebound faster due to limited supply.

Inland properties are more closely tied to local employment trends, infrastructure development, and population growth. Treating both as part of the same appreciation model produces unreliable forecasts and poor investment decisions.

6. Market Liquidity and Buyer Pools Differ

The buyer pool for beach properties is often international and discretionary, including second-home buyers and investors. Inland properties rely more heavily on local end-users. Liquidity, pricing sensitivity, and negotiation dynamics differ significantly between these groups.

When beach and non-beach properties are compared, the resulting data blends incompatible markets, producing averages and benchmarks that reflect neither accurately.

Making Better Caribbean Real Estate Decisions Through Better Comparisons

Comparing properties near the beach to properties not near the beach is a bad idea because they operate in separate economic ecosystems. They differ in demand drivers, scarcity, income potential, risk exposure, and buyer behavior. Using one as a benchmark for the other leads to distorted pricing, unrealistic expectations, and potentially harmful investment decisions. Accurate Caribbean real estate analysis requires comparing like with like—especially when proximity to the beach introduces such a powerful and measurable value premium.

Accurate comparable data empowers buyers to ask better questions, negotiate more effectively, and align purchases with their financial goals. It transforms property acquisition from an emotional decision into a strategic one. By insisting on comparisons that match bedroom count, location, and other key characteristics, buyers protect themselves from distorted valuations and unnecessary risk.

In an increasingly data-driven real estate environment, the responsibility to present and interpret data correctly is shared by platforms, agents, and buyers alike. When comparable data is used responsibly, it supports healthy markets, fair pricing, and long-term investment success. When it is misused, the consequences can be costly and enduring.

Ultimately, informed buyers are empowered buyers—and accurate comparable data is one of the most powerful tools they have.

Condo vs Hotel

* Do Not Allow Caribbean Real Estate Agents To Use A ‘Hotel vs Condo’ Comparison Chart As A Means To Convince You To Purchase From Them.*

Comparing hotel room occupancy to condominium occupancy is fundamentally flawed because the two metrics measure different economic behaviors, usage patterns, and revenue intents. While they may appear similar on the surface—both refer to “occupied units”—they serve entirely different analytical purposes. Below is a structured explanation outlining why they are not interchangeable.

There are Caribbean real estate agents in unregulated markets that will use misleading charts that are not an “apples to apples’ accurate comparison. Be critical of all charts/numbers/spreadsheets that you are given.

1. Purpose of Use Is Different

Hotels are designed exclusively for short-term, transient stays. Occupancy reflects nightly demand driven by tourism, business travel, events, and seasonality.

Condominiums are primarily residential assets. Occupancy often reflects long-term habitation by owners or tenants, not nightly demand. Even when condos are used for short-term rentals, this is typically a secondary or mixed-use function.

As a result, hotel occupancy measures hospitality demand, while condo occupancy measures housing utilization.

2. Time Horizon and Turnover

Hotel occupancy is calculated on a daily basis, with guests checking in and out frequently. A 70% hotel occupancy rate means rooms are filled 70% of nights over a period.

Condo occupancy is usually measured monthly or annually. A condo occupied by the same resident for 12 months is considered 100% occupied, regardless of how often the unit is physically used.

This difference alone makes direct comparison statistically invalid.

3. Revenue Models Are Not Comparable

Hotels monetize occupancy per night, with dynamic pricing tied to demand, seasonality, and events. Revenue per available room (RevPAR) is a core performance metric.

Condos generate value through:

Long-term rent

Owner use

Capital appreciation

Even in short-term rental scenarios, condo income is constrained by HOA rules, local regulations, and owner availability.

Thus, a “fully occupied” condo does not imply hotel-like revenue efficiency.

4. Operational Intensity

Hotels are professionally managed, with:

Daily housekeeping

Front desk staffing

Marketing and distribution systems

High occupancy requires significant operational infrastructure.

Condos generally have minimal operations. An occupied unit may require little to no daily service, making occupancy a passive condition, not an operational performance indicator.

5. Regulatory and Legal Constraints

Hotels are purpose-built and licensed for transient lodging.

Condos may face:

Short-term rental restrictions

Zoning limitations

HOA rules

Tax differences

These constraints directly affect how occupancy can be achieved and sustained, further separating the two metrics.

6. Vacancy Has Different Meanings

A vacant hotel room represents lost nightly revenue.

A vacant condo may be:

Intentionally held by the owner

Used seasonally

Reserved for personal use

Awaiting sale or appreciation

Vacancy in condos is often strategic, not indicative of weak demand.

7. Investor Interpretation Risk

Using hotel occupancy to justify condo performance (or vice versa) can lead to:

Overstated income projections

Mispriced assets

Incorrect yield assumptions

This is particularly relevant in Caribbean and resort markets, where condos are often marketed using hotel-style statistics that do not reflect real residential or rental performance.

Conclusion

Hotel occupancy and condo occupancy measure entirely different realities. One is a short-term hospitality performance metric; the other is a long-term residential utilization indicator. Treating them as comparable distorts valuation, misrepresents income potential, and creates flawed investment assumptions.

For accurate analysis—especially in mixed-use or resort markets—each must be evaluated using metrics appropriate to its asset class.

TIPS

1. When looking at comparables make sure the property types match correctly. You must always have an apple to apples comparison.

2. With all the data collected, market research, performance analytics collected and displayed on property marketplaces there is no excuse to not have an apple to apples comparison…why settle for similar when you can have the exact information? If your real estate agent says they don’t have the information that is needed, get a new agent. They clearly aren’t doing their job.

3. ROI charts need to be dissected by type of property, 1BR etc..location, some figures are going to be skewed due to types of properties at a specific location, hotels vs condos, vs homes, etc…

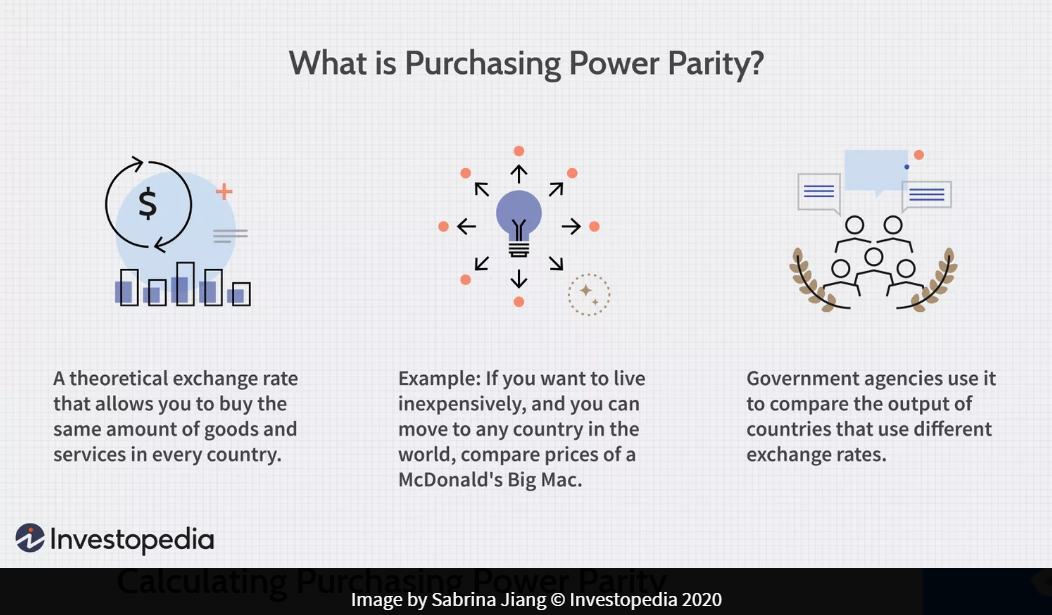

4. Before purchasing, each investor will need to compare potential countries by cost-of-living, quality of life factors, purchasing power parity, etc….

5. Using cost of living as a filter to narrow down locations, always combine it with income data (PPP) and quality of life metrics to make an informed decision.

6. Beware of certain companies putting out charts/reports encouraging investment because there is pure economic self-interest from the corporate side.

Data does not take into effect infrastructure, lifestyle, purchasing power parity, etc… all of these factors and more intimately affect whether an investor purchases or not. So the data is not an accurate presentation it is intended to represent. It’s an abstraction of reality. The more you look at data and realize that it ultimately is missing precise bits of important information the less you trust it.

Data is inherently partial, it’s all operationalized with a purpose, institutional context is absolutely necessary in Caribbean real estate.

If you have any questions about sourcing data before you purchase Caribbean real estate, or any purchasing Caribbean real estate questions in general then feel free to reach out to us here.